Clearer taxes, mandatory CIN, heavier penalties. The 2026 short-term rental reform reshapes the rules for those who rent out holiday homes in Italy, introducing changes that affect owners, managers, and even guests. From tax declarations to safety regulations, here is everything you need to know to stay compliant and continue renting without surprises.

Short-term rentals 2026: the regulatory revolution reshaping the Italian market

TL;DR: The 2026 regulations on short-term rentals introduce the mandatory National Identification Code (CIN), new tax rules with a 26% flat tax above a certain threshold, strengthened safety requirements, and penalties of up to €8,000. Anyone managing holiday homes must comply by specific deadlines to avoid fines and remain operational.

Anyone renting out a holiday home in Italy must now deal with a regulatory framework that has become more stringent and structured. The 2026 reform was introduced to bring order to a sector that grew rapidly, often without clear rules. Now everything changes: from how you declare your income to how you present your property online, all the way to the minimum requirements you must guarantee to guests. This is not bureaucracy for its own sake, but a system designed to protect those who rent responsibly and those who book with confidence. In this guide you will find the main updates, the deadlines to meet, what needs to be done immediately, and what can wait.

If you manage, or are considering managing, short-term rentals whether it is a seaside home in Puglia, a city apartment, or a villa with a pool, these rules apply directly to you.

Mandatory CIN: what it is and how to obtain it

The National Identification Code (CIN) is the core of the reform. Every holiday home, apartment, or room rented for short periods must have a unique CIN, obtained through the national portal of the Ministry of Tourism. It is used to uniquely identify the property, make it traceable during inspections, and ensure transparency. It is not a simple bureaucratic registration: without a CIN you cannot publish listings on platforms such as Booking or Airbnb, you cannot operate legally, and you risk immediate penalties. The CIN must be displayed visibly outside the property and included in all online listings.

The procedure requires cadastral data, proof of ownership or a lease agreement, an updated floor plan, and a declaration of building compliance. Obtaining it is not complicated, but it does require organization: many owners rely on consultants or accountants to avoid mistakes that could slow down the process.

New tax rules and flat tax (cedolare secca)

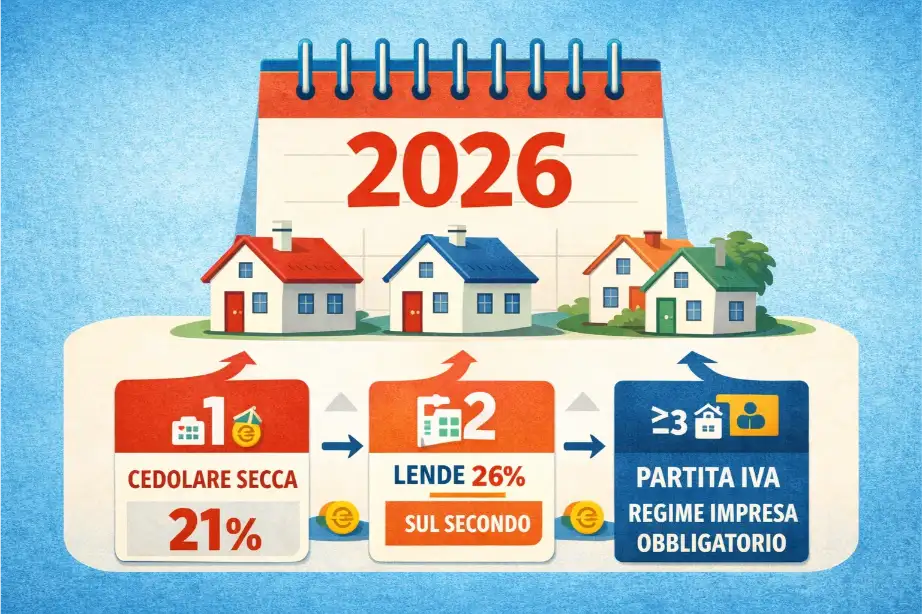

The taxation of short-term rentals changes radically. Until 2025, the 21% flat tax (cedolare secca) applied to the first property, while the 26% rate applied to the second, third, and fourth properties.

From 2026, the 21% flat tax (cedolare secca) applies only to the first property, while the 26% rate applies exclusively to the second. Anyone who owns more than two properties used for short-term rentals is required to open a VAT number, as the activity is considered entrepreneurial in nature.

Safety requirements and liability

The 2026 regulations impose higher safety standards than in the past. Every property must be equipped with smoke detectors, a compliant fire extinguisher placed in an accessible area, and clearly visible emergency signage.

The liability of the owner or manager also increases on the civil side. If a guest is injured due to lack of maintenance, non-compliant systems, or missing safety devices, the risk is not only an administrative fine but also compensation for damages. Civil liability insurance for short-term rentals becomes mandatory.

Quick tips box:

- 🔥 Combustible gas detectors (methane/LPG) and carbon monoxide (CO) detectors

- 🧯 Compliant 6 kg fire extinguisher

- 📋 Civil liability (RC) insurance

Practical tips to get compliant

Start by checking whether you already have everything in place or need to act immediately. Review your cadastral documentation: updated floor plan, cadastral records, and building compliance. If anything is missing, contact a surveyor or architect before applying for the CIN. Gather compliance certificates for electrical, gas, and plumbing systems. If you have never obtained them, now is the time. Install safety devices through a licensed technician who can issue the required certifications. Do not purchase fire extinguishers or detectors without having them certified: in the event of an inspection, they will not be considered valid. Open a dedicated tax position if you do not already have one, even if you rent only occasionally. This is necessary to issue receipts and track all payments. Set up a separate bank account for rental income: it simplifies accounting and ensures transparent cash flows in case of audits. Take out a short-term rental civil liability insurance policy with adequate coverage limits, at least €1–2 million.

When to comply and how much time it takes

Deadlines are staggered but close together. The CIN must be requested by March 1, 2026 for those already renting, and within 60 days from the start of activity for those who begin later. Safety devices must be installed and certified by April 30, 2026. Tax registration and communications to the Revenue Agency start from the first contract signed in 2026, even if you have never done so in the past. The 2026 summer season will be the first real test: anyone who is not compliant by May risks being unable to rent during the months with the highest income. Keep in mind that obtaining the CIN can take from 10 days to 2 months, depending on how complete your documentation is. Certifying systems and safety devices requires an additional 2–3 weeks. If you are starting from scratch, plan for at least 60–90 days overall.

FAQ

Is the CIN mandatory even if I rent only 2–3 times a year?

Yes, the CIN is mandatory for anyone who makes a property available for short-term rentals, regardless of frequency. Even a single rental contract per year requires an identification code. The only exception concerns those who rent out their primary residence for a maximum of 30 total days per year, but even in this case many Regions are extending the requirement. It is best to check the local regulations of your municipality and avoid risking penalties for just a few rentals.

Can I manage everything on my own without an accountant or consultants?

Technically yes, if you are comfortable with online procedures and bureaucracy. The CIN portal is accessible and guided, but it requires precise documentation. The tax side is more complex: you must register contracts, communicate with the Revenue Agency, calculate and pay the flat tax. A mistake in the tax return can cost more than professional advice. If you rent occasionally and have time, you can try to handle it yourself. If you manage multiple properties or lack experience, professional support is an investment that pays for itself.

What happens if I do not comply by the deadlines?

You risk immediate penalties and suspension of your activity. Without a CIN, you cannot publish listings and platforms will remove your ads. Without certified safety devices, an inspection can result in fines of up to €6,000 and closure of the property. Failure to make tax communications leads to cumulative penalties for each omitted contract. In addition, if you collect rental income without being compliant and are discovered, tax penalties are added to administrative ones. Delaying is not worth the risk.

Does Puglia have different requirements compared to other Regions?

Yes, Puglia adds regional obligations to the national framework. You must register on the Puglia Promozione portal, report guest arrivals within 24 hours through Alloggiati Web, and comply with any municipal regulations regarding the number of rentals or aesthetic modifications. Some coastal municipalities have additional restrictions in historic centers. Puglia also makes a clearer distinction between holiday homes and B&Bs, with specific health requirements if you offer breakfast. Always check your municipality’s resolutions in addition to regional regulations.

Do I need a specific insurance policy for short-term rentals?

It is not formally mandatory, but it is strongly recommended. A short-term rental civil liability (RC) policy covers third-party damage, guest injuries, damage to the property caused by guests, and the owner’s civil liability. Costs start at around €150–200 per year for a single property, with coverage limits of €1–2 million. Many online platforms are making it almost mandatory in order to accept bookings. In the event of an accident without insurance, you risk having to pay potentially high compensation out of your own pocket.

Do the rules also apply to Airbnb and Booking?

Yes, all online platforms are legally required to verify that every listing has a valid CIN. Airbnb, Booking, Vrbo, and others have already started requesting the identification code to keep listings active. Anyone who fails to provide it by the deadlines will see their listing suspended or removed. The platforms also transmit data to the Revenue Agency, cross-checking contracts and payments. You cannot avoid inspections by operating only online; on the contrary, this is exactly where controls are more automated and stricter.

Conclusion

The 2026 short-term rental regulations are not an obstacle, but an opportunity for those who work seriously and want to stand out. Clearer rules protect honest property owners from unfair competition, reassure guests about quality and safety, and bring transparency to a market that has long been confusing. Getting compliant requires time, documentation, and some investment, but it allows you to operate with peace of mind and enhance the value of your property. Guests are looking for certified, insured homes managed by reliable professionals.

Those who adapt first will gain a clear competitive advantage. Puglia and Salento remain highly sought-after destinations, with growing demand for high-quality rentals. This is the right time to invest in compliance, raise standards, and position yourself as a serious operator. Do not wait for deadlines: start now by gathering documents, checking systems, and installing safety devices. Every week that passes is one less opportunity to be fully prepared for the summer season. If you have doubts or need support navigating CIN requirements, registrations, and certifications, rely on professionals who know the area and work daily with property owners and accommodation providers.

Discover the available accommodations with Salento Prime. To best organize your base and transfers, contact us here or start a chat on WHATSAPP.